Key Affordable Care Act Provisions to Consider

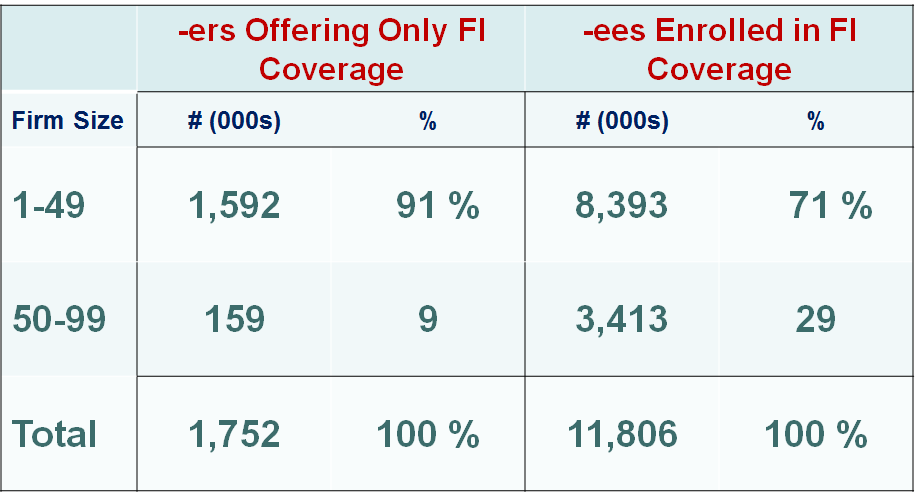

For employers with 51 to 100 employees, 2016 will bring several new changes. Up until 2016, all states defined small groups as 1 to 50 employees. Beginning in 2016, all states must redefine a small group as 1 to 100 employees. So, if a company has 51-100 employees and fully insures its health plan, the insurance carrier will transition the company’s coverage to the carrier’s small group segment. This change potentially increases the small group pool of covered employees by 40+%.

Yet, more importantly, the transfer exposes an employer that had formerly been in a pool with other larger-size employers to significant rate uncertainty come January 1, 2016.

For employers with 51 to 100 employees the change to small group also exposes the employer’s plan to several new provisions of the health care law as shown by this chart:

The move to the small group segment institutes several new provisions to the formerly large employer’s coverage, these include:

- Modified Community Rating – With modified community rating, the employer’s insurance premium will now be subject to the Affordable Care Act’s rating limitations which allow for premium differentiation only for age, family size, tobacco usage, and geography. No longer can the insurance carrier consider employer-specific historical claims, industry, gender mix, and other factors. Employers with workforces that are predominantly young, male, and healthy will likely see the greatest premium changes under the new small group definition.

- Essential Health Benefits (EHB) – All qualified fully insured small group and individual health plans must offer unlimited coverage for all ten essential health benefits. The large group insurance market typically exclude some of these essential health benefits, in particular pediatric dental is typically excluded from large group plans. “Newly small employers” offering a separate dental plan will likely discover they are double-paying for pediatric dental coverage.

- Minimum Loss Ratio – The Affordable Care Act sets an 85% minimum loss ratio for large group insurance and a lower 80% minimum loss ratio for small group insurance. As a result, “newly small employers” are almost certain to experience a minimum 6% increase in health premiums in 2016.